My Budget 360The biggest scam of the century is making a full conclusion with this deep recession. What made America the envy of the entire world, a strong and vibrant middle class, is being quickly dismantled so the new order of corporate raiders can siphon off life support from the productive economy. Nothing highlights this grand robbery more so than the current situation of our country. For eight straight months foreclosure filings have hit 300,000 or more yet banks on Wall Street are gearing up for record yearend bonuses for a job well done. The average American is seeing the culmination of 40 years of systematic leeching by the corporatocracy that culminated in the largest transfer of wealth in modern history. A bloodless coup that cemented the true nature of our current economic system.

People wonder why I focus so much on the middle class of America. This is what has been the fundamental difference between our country and other economic systems. A vibrant middle class that provided adequate housing, a decent education, and a road to sustainable wealth. This was built on the backs of a productive economy. But over the last 40 years we have seen much of the true wealth shift to Wall Street and the financial sector and that has largely eroded the value of what it means to be middle class. The new system is designed for the few and by the few. The new financial regulation being touted as the most sweeping since the Great Depression is woefully weak. Yet this is merely a reflection of the power of the corporatocracy. We really have the best government money can buy.

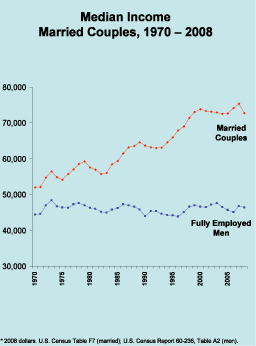

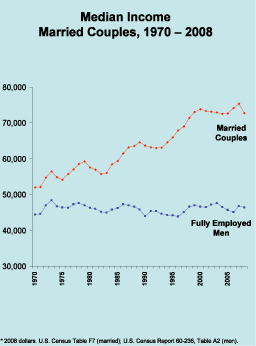

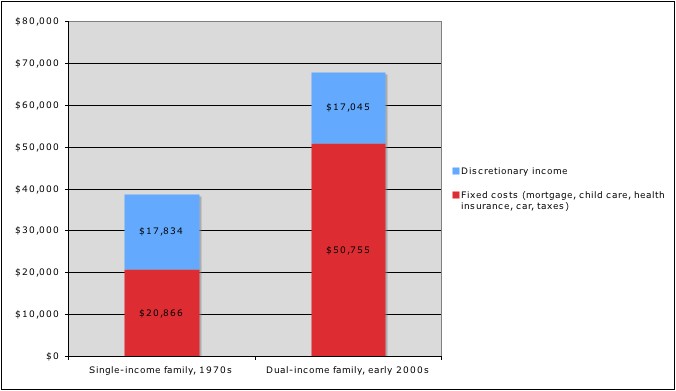

Critics always point to the rising household wages since the 1970s. Yet there is a big problem with this argument since this has occurred with the growth of the two income household:

*Source: Elizabeth Warren

If we factor out men from the data, the average American male is now making $800 less in inflation adjusted terms than his counterpart in 1970. So even though income for households has gone up the data is misleading. Americans now have a harder time keeping the pillars of middle class life intact. If we had to sum it up it would probably be:

-A good home to raise a family

-Access to a good education

-Quality healthcare

-A decent retirement

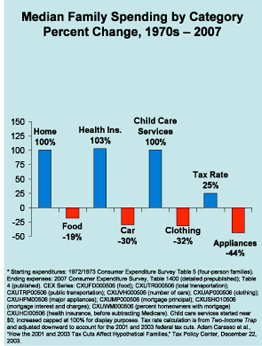

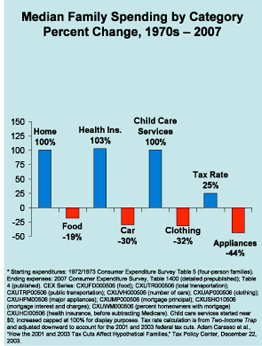

The above is still accessible but it has become harder to maintain. A solid pension and healthcare used to be provided to workers by companies. That is now gone. Income is only one side of the equation of course. Where do people now spend their money? If we look at the data closely Americans now spend less in clothing, food, and appliances than their 1970s comparison group. This has much to do with cheap goods from abroad and more competition globally. So this is good right? It is but these are more of the smaller line item purchases that Americans make. The biggest purchases include housing and this is a cost that has gone up exponentially:

Housing has gone up 100% in terms of cost for the typical family. Health insurance is now up 103%. Childcare, a more daily need for two income households, has gone up as well since Americans many times need two incomes merely to break into the more elusive middle class. The items that have fallen are largely adjustable and elastic substitutes. For example, you can have macaroni and cheese instead of a steak. Everyone needs shelter whether they buy or rent.

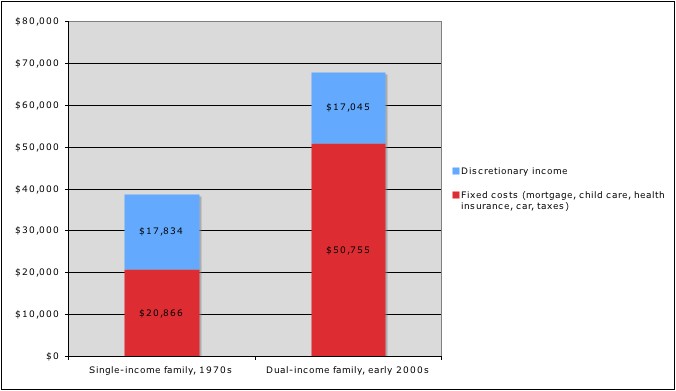

The gigantic housing bubble has only pushed the tide out further to reveal the disappearing middle class. If we break down the data further from a study examining the middle class we find that fixed costs are now through the roof. What is more troubling is that even with two incomes, the ability to sustain a middle class lifestyle has actually gone backwards:

Source: Rortybomb

There is also more volatility on income security. Wall Street and the corporatocracy are running the biggest hypocrisy show in the world. Middle class families are having to adjust to the new economic reality by filing for bankruptcies, losing homes in foreclosure, and getting gouged with credit cards. Yet banks and Wall Street have not cut back and have gone the opposite direction by giving out record bonuses to their small circle of cronies. The bailouts were a large protection of the entrenched corporatocracy.

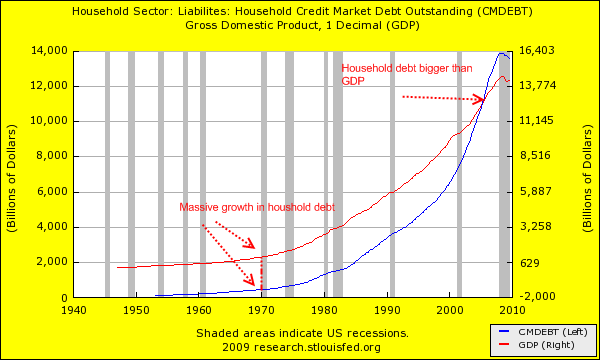

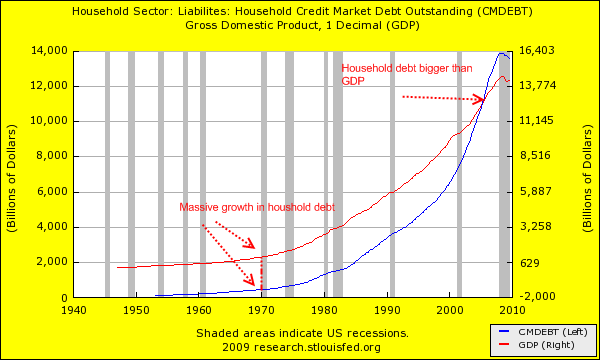

The biggest scam of the century revolves around the massive growth in debt. Let us chart this back to the 1970s:

The U.S. Treasury and Federal Reserve disconnected the U.S. dollar from any semblance of reality back in the 1970s. Since that time, Americans have been put into a sleepwalking state where they were drunk on debt induced spending while slowly and surely our manufacturing base was removed from the country. The above chart hit a climax when household debt actually surpassed annual GDP in this decade. In other words, we spent way more than we earned and nothing that operates under that system can survive for any length of time.

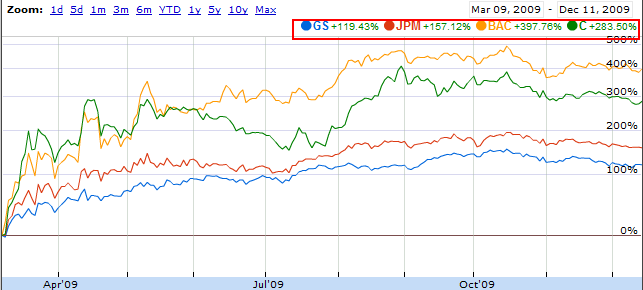

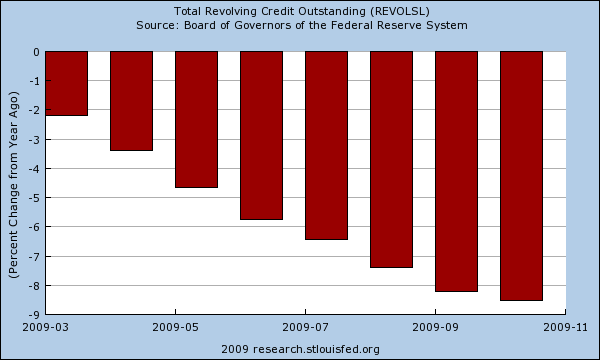

This has infuriated many since they thought they were part of the new economy but in reality, they were merely treading water until Wall Street and the banks had to hunker down and protect their small inner circle. Why else is the stock market up 60 percent since the March lows? Let us look at some data since March and see how well Americans have been doing:

March 2009 unemployment rate: 8.5%

December 2009 unemployment rate: 10%

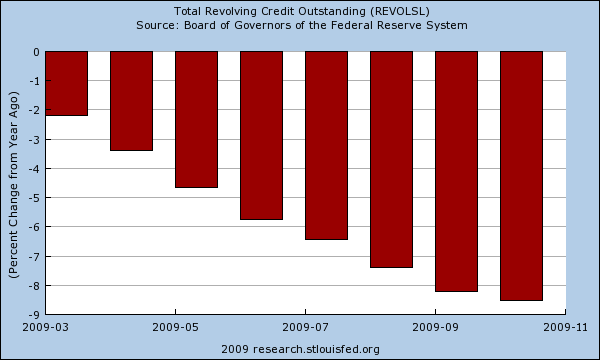

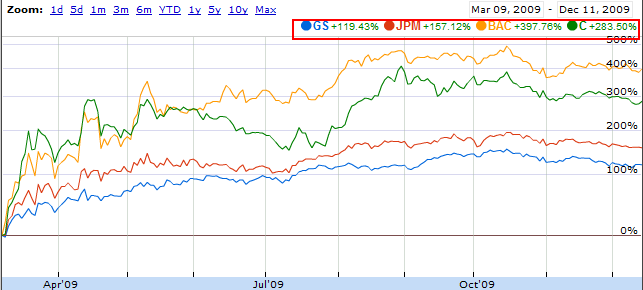

The unemployment rate shot up from 8.5% to 10% in this time and consumer credit has been contracting at a record pace. At the same time, banking profits are going sky high. Take a look at some of the big banking names:

The corporatocracy seems to be doing well in this climate even though the middle class American lifestyle is being dismantled piece by painful piece. Not only is this happening but Americans now have a new line item and that is to fund the bail outs. This is happening through more clandestine channels like destroying the value of the U.S. dollar by printing inordinate amounts of money so banks can keep on giving record bonuses. The financial sector is a blood sucking vampire that is draining the real economy of its life. Why do we even need it at the current size? All mortgages are now backed by the U.S. government through the GSEs or FHA insured loans. Credit card debt and access is shrinking. Banks have curtailed lending to small business. What is the financial sector doing to justify their current profits? Pure and simple speculation on the taxpayer dime. This isn’t capitalism as Adam Smith envisioned. This is a system called a corporatocracy where the main goal is protecting the too big to fail and allowing everyone else to fail.

The average American has every right to be furious at what is occurring. The next generation might have it worse than the last. Not since the Great Depression has this occurred. Some might say that this was destined to happen. That is the storyline the corporatocracy would want you to believe so popular anger can be quelled. Yet this was a deliberate stealing from the American people. Many of these Wall Street elites have no allegiance to the country. They put money in secured tax havens in other countries and hide their money in multiple places avoiding taxes from a country that allows them to run their scam. They have allegiance to only one and that is money. They don’t care about the productive economy of the U.S. Lobbying with their fleet of lawyers is simply another business expense. And here we are, 40 years later with a disappearing middle class, booming financial stocks, millions of foreclosures, and weak financial regulation. Nothing can be clearer than where the power has shifted.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

TAGS: banking,

corporate power,

Finance,

middle class,

wall street,

wealth

No comments:

Post a Comment